Since the first quarter of 2018, the price of NAND flash has been falling steadily. The major reason is that the capacity of 64 or 72 Tier 3D NAND flash is increasing dramatically, while the demand has dropped. The requirements of the smartphone market have been declining for several consecutive quarters. The factors contributing to Q3 peak season weak vary, such as Apple's new product is not good as expected and the shortage of Intel CPU also affects the PC market, as well as the trade war between China and the United States. Output value of NAND flash industry is only $170 billion, a slight growth of 4.4%, when the price has fallen by 10-15%. Looking ahead to the fourth quarter, demand will continue to weaken, leading to complicating price reduction trend.

According to the latest report of DRAMeXchange, as 64 or 72 Tier 3D NAND flash generally matures and supply continues to increase, 3Q18 NAND flash supply has grown steadily. But the demand is affected by various factors, such as Apple's new product sales are not good as expected and the shortage of Intel CPU also affects the PC market, as well as the trade war between China and the United States, resulting in weak season. Oversupply is still difficult to eliminate since the beginning of the year. The contract prices of NAND flash are still falling, with average price dropping by 10-15% in the third quarter.

As for the fourth quarter, Dramexchange analyst Ye Maosheng pointed out that demand continued to weaken due to the completion of festival stocks in Europe and America, the restraint of inventory by module factory and OEMs, and the ongoing trade war between China and the United States. It’s estimated that the fourth quarter remains oversupplied and contract prices of various products will decline more sharply. In order to maintain gross profit and reduce inventory, it is expected that the price competition between enterprise SSD and wafer will be more intense.

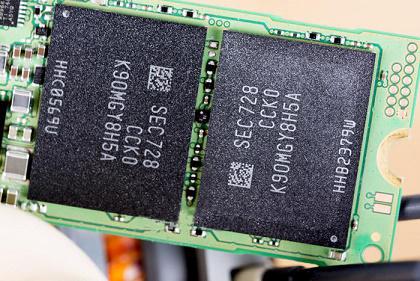

Samsung

Although overall demand is not as good as expected, Samsung's third-quarter shipments continues to grow by more than 20%, thanks to its dominance in the flagship smartphone market and the continued shipment growth in server and PC SSD. Unfortunately, the average unit price falls by nearly 15% for weak price trend. Revenue in the third quarter is $60.5 billion, up 2.1% from the previous quarter. From process and capacity analysis, Samsung has adopted a fifth-generation process in client-level SSD products, which will be gradually imported into PC SSD and mobile UFS. However, due to the significant oversupply, Samsung will slow down the transition to the fifth-generation process, with dominantly outputting 64 or 72 Tier process in 2019.

SK Hynix

Driven by the growth of smartphone shipments and SSD sales, SK Hynix’s shipments in the third quarter can still grow by 19%. As demand is not as good as expected, SK Hynix cann’t reverse the oversupply situation, resulting in the average unit price decreased by 10%. Overall revenue is $1.83 billion, an increase of 6.0% over the previous quarter. In terms of product portfolio, SK Hynix focuses on the mobile device market. With the launch of Apple’s new product and introduction to full-screen mobile phones by Chinese manufacturers, SSD whose capacity is more than 128G performs well when equipped with higher specifications of product, contributing to steady growth of bit shipments. In addition, with the help of 72 Tier NAND flash, SSD shipments accounts for more than 20% this quarter.

Toshiba

Similarly benefiting from Apple's new product and the continued increase in capacity of Chinese smartphone manufacturers, Toshiba keep growing shipments by more than 20% in the third quarter. However, affected by the continued decline in terminal product prices, average unit price drops by nearly 15%, making overall revenue at $3.2 billion, up 1.9% from the previous quarter. From the perspective of process and capacity, the current 64 Tier 3D NAND output accounts for over 70%, and the proportion of 3D NAND investment also officially exceeded 50%. In 2019, the focus of production expansion will be on the new capacity of Fab 6. But given the oversupply and process maturity, 64 Tier will be the main production process.

Western Digital

In the third quarter, in addition to maintain the advantages of retail and channel business, high-capacity UFS products began to be officially shipped by Western Digital. Through preferential prices in the SSD market to achieve good performance, Western Digital’s shipments

All Rights Reserved, Copyright 2008-2025 Mari Technology Information co.,ltd