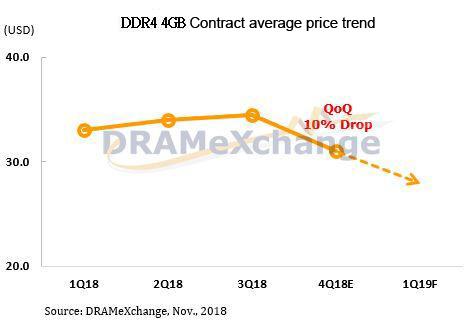

Since the second half of 2016, global memory chips have entered a new peak season. The price of DRAM memory and NAND flash has risen sharply since then and continued until 2018. Nowadays, the price of NAND flash has plummeted, completely reversing the price trend, while that of DRAM memory has maintained until now. Although the price of DRAM chips has been rising slightly in the first three quarters, it has fallen sharply since October, with 4GB and 8GB memory modules dropping by 10%, which is expected that this trend will continue in 2019, thereby the average unit price falling by 20%.

According to the latest report released by DRAMeXchange, the contract price in October began to slip sharply, even in the case of major manufacturers have agreed on the fourth-quarter contract price. The average price of the 4GB mainstream module fell from$34.5 in the previous quarter to $31, a drop of 10.14%, while the large-capacity 8GB module has fallen more sharply, from $68 in the previous quarter to $61, a drop of 10.29%. Since the DRAM market just begins to oversupply, prices are likely to continue to drop in November and December. As various manufacturers actively seek sales, the decline of the 8GB solution is expected to continue to be higher than that of 4GB solution.

Wu Yating, senior associate of DRAMeXchange, pointed out that the spot price as the leading indicator of price has continued to weaken since the beginning of this year, and the overall price in October continued to weaken like September. According to the latest quotation, the spot price of mainstream trading granules 1G*8 has dropped to $6.946, a 5% price difference compared with the contract price of $7.31, and the subsequent contract price will continue to decline. Under the situation for market oversupply, manufacturers are eager to increase sales before prices fall further, so that the penetration rate of PC DRAM 8GB modules will rise rapidly, exceeding 4GB modules in quantity and becoming the mainstream in the market. Therefore, DRAMeXchange contract quotation will also be based on 8GB.

The off-season is coming, and the price decline may continue to expand in the first quarter of next year.

In the PC market, affected by unsatisfactory supply of Intel CPUs, component price will continue to increase as the industry is about to enter the traditional off-season from the peak of shipments. In addition, oversupply has caused DRAM prices to rise for nine consecutive quarters. Once the market begins to reverse, the downward pressure on average selling prices will cause prices to fall rapidly and drastically.

Looking forward to the market conditions in the first quarter of next year, in addition to PCs, terminal products such as servers and smartphones will also face downgrades in shipments. Besides, the DRAM industry needs time to digest channels and excess inventory on the procurement side, representing the contract price agreement will be a serious challenge in the first year of next year. The quarterly contract price agreement will be a serious challenge. Overall, DRAMeXchange estimates that the average DRAM sales unit price in 2019 may fall by 20%; for suppliers, profitability has reached its peak in the third quarter of 2018, depending on each manufacturer's cost-down capability, profitability will in a soft-landing situation each quarter.