As both of memory and flash memory have price drops, the day of SK Hynix comes to an end

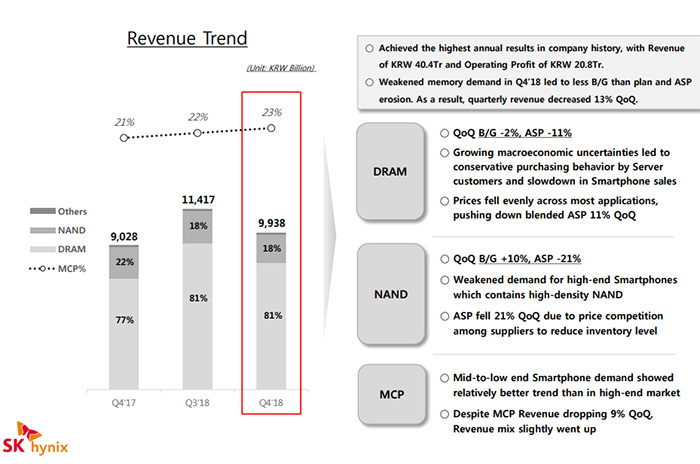

Semiconductor chip, which is core technology of Korea, occupys one fifth of its exports, which thanks to Samsung and SK Hynix who account for 70% global DRMA shares. Samsung and SK Hynix benefit most during memory chip price rising during last two years, who keep setting earnings records. However, memory price has fallen since 2018 Q4, together with flash memory price dropping, make memory chips turn into bear market form bull market, which also drags performance of Samsung and SK Hynix. Revenue is predicted to reduce by 38% according to Samsung. SK Hynix releases 2018 Q4 financial report today. Its quarterly revenue has a 32% drop compared with last quarter due to 11% memory price drop and 21% flash memory drop. Net margin has a 28% drop compared with last quarter and a 6% rising compared with last year.

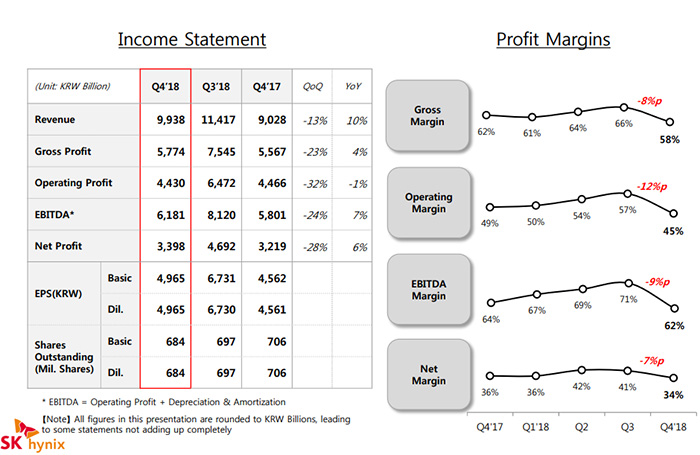

According to 2018 Q4 financial report released by SK Hynix today, quarterly revenue is 9.938 tirllion won (about $8.82 billion), which has a 13% QoQ decline and a 10% YoY rising. Its gross margin is $5.1 billion with a 4% YoY rising and a 23% QoQ decline. Operating profit is $3.9 billion wiht a 1% QoQ decline and 32% YoY decline. Net margin is $3.02 billion with a 6% YoY rising and a 28% QoQ decline.

QoQ falling of operation profits leads to decline of Q4 gross margin, which is 66% in Q3 falls to 58% in Q4. Its operation falls to 45% and net margin falls to 34% from 41% in last quarter.

Although earnings in Q4 is less than before, the third quarter of 2018 has an upward tendency. As a result, there is still a surge in whole year performance of SK Hynix, whose total revenue is up to $1.86 billion with a 52% YoY rising. Net margin is $13.75 billion with a 46% YoY increase.

Briefly, their days are going on while Q4 is a turning point, so it will be difficult in 2019, at least the first half of next year.

The reason why SK Hynix having difficult time is that both memory and flash memroy price fall. Memory shipments of Q4 reduce by 2% compared with last quarter. Average price of ASP falls by 11%. NAND flash memory shipments increase by 10% while its price reduces by 21%. Due to tough global ecnomic environment, low demand of server and smart phone market.