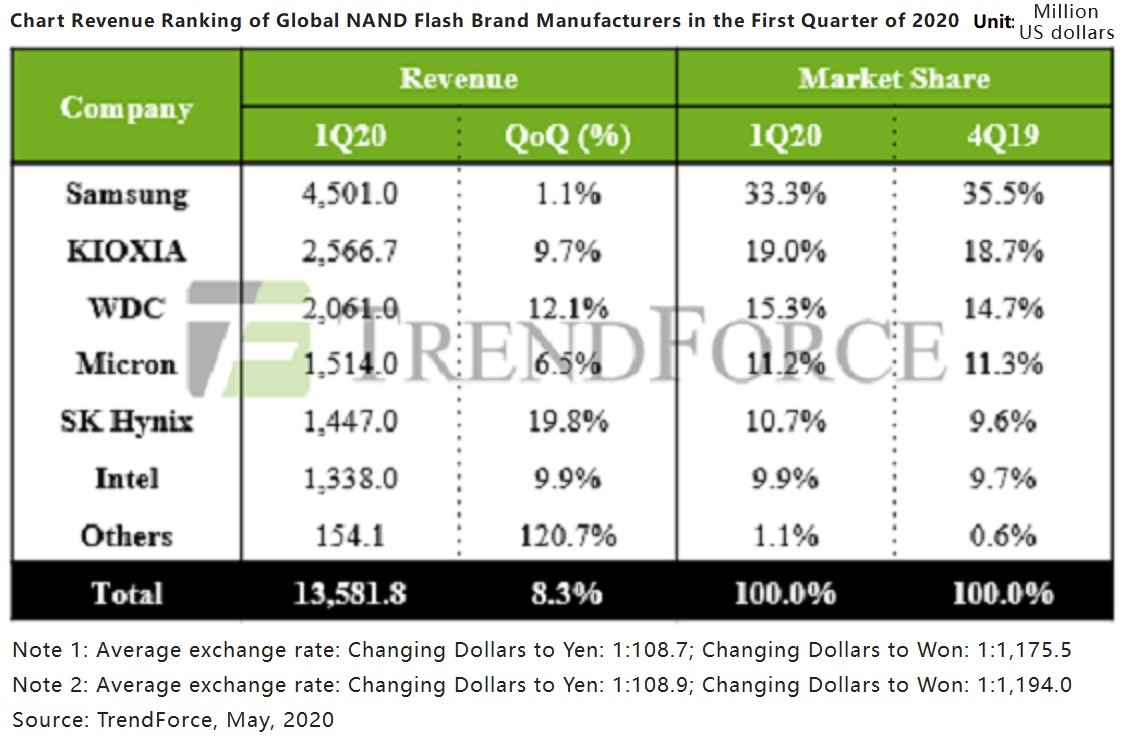

As the strong demand for data centers, NAND flash memory industry's Q1 revenue in 2020 increases by 8.3%

As the strong demand for data centers, NAND flash memory industry's Q1 revenue in 2020 increases by 8.3%

Although the epidemic has an impact on various industries, the bit shipments of NAND flash memory in the first quarter of 2020 are flat compared with the previous quarter. What’s more, higher average selling prices due to the larger demand for data centers, the total revenue increased by 8.3% compared with the last quarter, reaching 13.6 billion US dollars.

According to DRAMeXchange's market survey, the demand for SSDs in data centers has increased since the fourth quarter of last year. Enterprise-level SSDs are still in short supply in the first quarter. In addition, as suppliers’ excessive inventories been almost cleared, the inventories have come to a normal level, so contract prices of flash memory have gradually increased. Production has been resumed after March, although the COVID-19 has a certain impact on consumer-grade computers and smartphones, while their production plants being shut down and the components supply chain and logistics chain being affected a lot, either.

Due to epidemic there are many people who are remotely working and teaching around the world, so the demand for laptops or tablets has increased rapidly. Especially, a big part of purchasing is from enterprises or governments, which is a quite large. In addition, services such as remoting service and video streaming have demand for cloud servers and data centers, so the demand for enterprise-class SSDs remains strong.

It is expected that due to the strong demand for overall equipment in the second quarter, NAND flash memory will also be in short supply as the increasing market demand, so the contract price will continue to rise. And the manufacturer's revenue will continue to grow. In other words, SSD prices will grow.

Specific to the situation of various manufacturers, Samsung's market share declined slightly this quarter, while its revenue was basically the same as the previous quarter. KIOXIA's market share increased slightly with 9.7% growth in revenue; Western Digital's market share also slightly increased with a 12.1% growth in revenue. Micron’s market share was basically flat with a 6.5% growth revenue. SK Hynix ’s market share increased by one point, while its revenue apparently increased by 19.8%; Intel ’s market share was basically flat with a 9.9% growth in revenue.