How will Western Digital expand from traditional HDD market to SSD market rapidly?

Western Digital was set up in 1970, since the day of purchase in 2012, it has finished the era when there was a situation of tripartite confrontation in hard disk market and it has also been promoted to be the first one in the field of global mechanical hard disk. With the development of technology and the flourish of Internet information, the global data volume is averagely increasing at a rate of 20% to 30% per year, which brings Western Digital tremendous commercial value.

However, with the rise of Big Data, Cloud Computing, Internet, Artificial Intelligence and other concepts, the need of computing data efficiently and transferring in high speed is on the increase day by day. Besides, Data Centre, Enterprise and Personal Computer’s demand for SSD is increasing immensely. These recreate the demand of traditional HDD market.

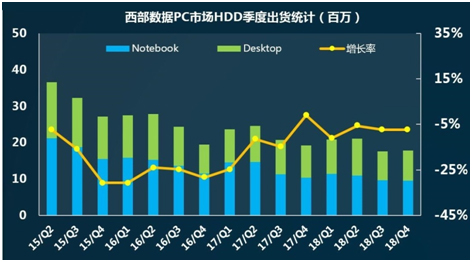

Data Source: The Financial Report of Western Digital,

18/Q4 (That means, 4-6 months in 2018)

According to the newest Financial Report of Western Digital shows, the HDD shipments are 39 million in 4-6 months, 2018. Its shipments rose 7.1% month on month while decreased 0.8% compared with the same period of last quarter. Since 2015, the HDD shipments of Western Digital have decreased for more than ten quarters compared with the same period of last quarter. In order to reverse the trend of HDD shipments decline and seize the market opportunities of rapid growth of SSD, Western Digital bought SanDisk in 2016. Because SanDisk cooperates with TOSHIBA in NAND Flash for a long time, it gets chip resources of NAND Flash and becomes important global supplier of NAND Flash.

The competition among the original factories of Flash is very intense. On the one hand, all of them are increasing capital expenditure to build new factories and expand production capacity. On the other hand, they are fighting with open and secret means on the technology of advanced 96 layers and QLC NAND. At present, the 3D NAND technology of Western Digital is in the lead. It is the first one to claim that it has successfully developed 96 layers’ 3D and QLC NAND. The maximum capacity of single Die can be 1.33Tb and it has begun to submit samples. It is predicted to be put into mass production in 2019. Besides, it increases equipment investment for the new factory of Fab6. At the same time, it is going to build new factory of Fab7 to work in with the new generation of 96 layers’ 3D NAND technology so that the mass production could be achieved quickly.

In the rapidly changing storage market, especially the capacity explosion period when the 3D NAND technology develops so fast, the upper technology development of Flash’s original factory, the change of productivity, the strategy of market and so on, they are all crucial to the trend of latter NAND Flash market. The market share of NAND Flash that was taken up 30% by both Western Digital and TOSHIBA, the development process of new technology, the planning of new factories and the strategic layout of market in the future are all the focuses the people who are in the circle concern. These are also important factors which may affect the market quotations of NAND Flash.

In addition, SSD is demanded strongly at data centre and is also increasingly needed in consuming market. According to China Flash Market, the global SSD shipment was 157 million in 2017 and it is predicted to be 192 million in 2018. It could even be 200 million which is increased more than 22% compared with 2017.

As same as the hard disk factory, Seagate purchased LSI flash memory department from the semiconductor device supplier Avago Techologies in 2014. This means that Seagate got related master technology and property rights, helping distribute the product lines of SSD. Furthermore, Seagate takes part in buying TOSHIBA TMC so that it has signed a long-time supply agreement of NAND Flash with TOSHIBA TMC. TOSHIBA will supply SSD combination products of Seagate with NAND Flash at present and in the future.

In the face of threats from Seagate, how can Western Digital make use of NAND Flash’s resources, expand the product lines of SSD and combine HDD products to meet the requirements of large data storage? At the CFMS summit on September 19th, 2018, the senior vice president Christopher Bergey of the Western Digital product market’s strategy and management will make a speech whose topic is “The newest technology of Western Digital and global strategic planning”, sharing the latest trends of Western Digital and the expectation of the storage market in the future.

The senior vice president Christopher Bergey of the Western Digital product market’s strategy and management is responsible for the market supply and strategy of large data, client, flush door and mobile product. Defining products, market strategy and terminal application are also included. Before, Mr Christopher Bergey took the chair of vice president of Western Digital flush door and integrated solutions. He was concentrating on formulating and pushing the product strategy of computer market and reclaiming the new markets of car, family, intelligent city and industrial internet.

Under Western Digital, there are G-Technology, HGST, SanDisk, Tegile, Upthere and WD. These are all data-centric products of different brands. In the future, how can they supply the global clients with great products, excellent client service and solutions of being in the lead? Let us look forward to listening to the wonderful speech that the senior vice president Christopher Bergey of the Western Digital product market’s strategy and management will bring.