TSMC releases its Q4 financial report: revenue is $9.4 billion with a peak motivation of 7nm

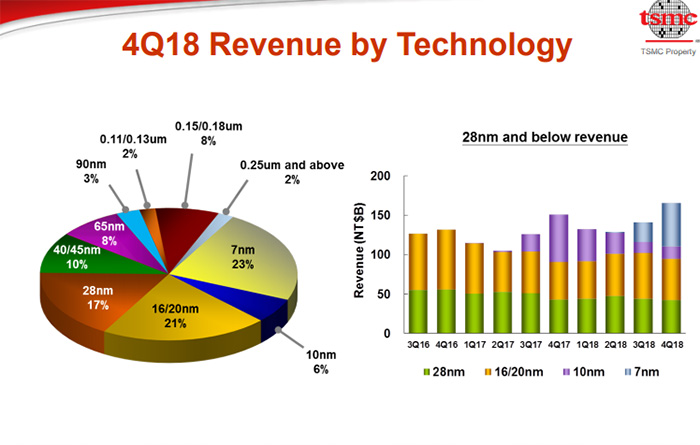

As UMC and Globalfoundries announcing quit of competition of 14nm and 7nm process below, there are only two companies, Samsung and TSMC, in global advanced foundry market. Although Samsung’s 7nm process is supplemented by EUV process, its mass production schedule is behind TSMC so all of 7nm orders is occupied by TSMC. According to 2018 Q4 financial report released by TSMC, its quarter’s revenue is up to NTD 289.77 billion(about $9.4 billion) with a 4.4% YoY growth and a 11.3% QoQ growth of which 7nm process contributes 23% revenue to be a peak motivation.

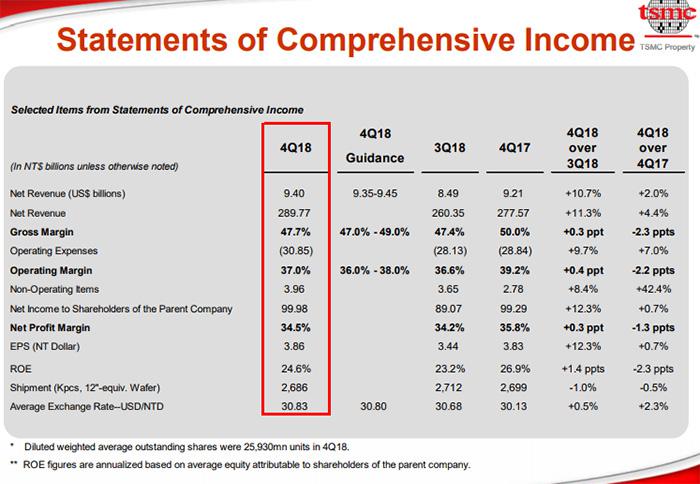

TSMC’s Q4 revenue is $9.4 billion which increases by 2.0% compared with last year and 10.7% compared with last quarter. In other words, its revenue is NTD 289.77 billion with a 4.4% YoY growth and a 11.3% QoQ growth. Gross margin is 47.7% with increases by 3% compared with last quarter and decreases by 2.3% compared with last year.

As for profits the operating margin reaches 37.0% and net profit is 34.5%. Q4 net profit belonging to shareholders is up to $3.24 billion with a 0.7% YoY growth and a 12.3% QoQ growth. TSMC maintains growth in performance while net profits don’t increase at the same time. It shows Q4 performance is being tested by operating growth which is 7% compared with last year and 9.7% compared with last quarter.

7nm process becomes a main source of TSMC’s Q4 income consititution, due to its shipment accounting for 23% which is over 20% as expected. Then 16/20nm process accounts for 21%. 28nm is third one in revenue with a 17% profit.

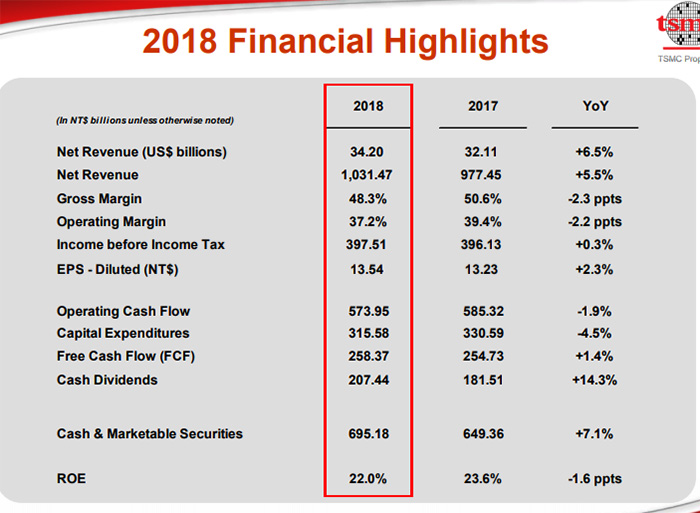

TSMC’s annual revenue is $34.2 billion which increases by 6.5%. Its revenue is NTD 1031.47 billion with a 5.5% YoY growth. Growth margin is 48.3% which decreases by 2.3. Annual pretax profit is $12.9 billion with a 0.3% YoY growth.

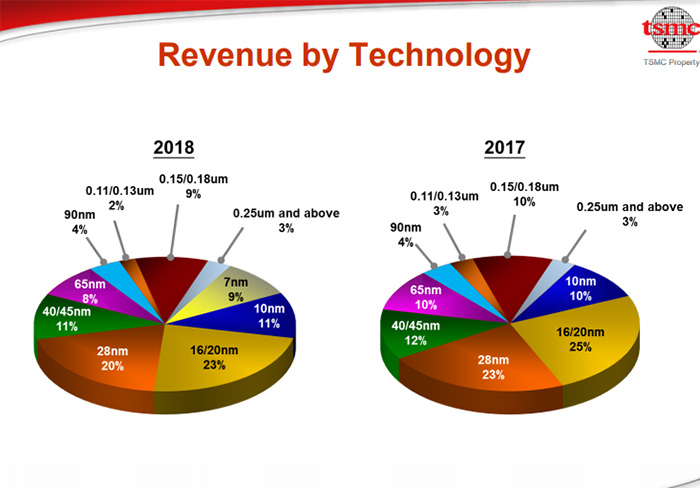

Among annual revenue of various technologies, 16/20nm technology contributes 23%, 28nm contributes 20%, 10nm contributes 11% and 7nm contributes 9%.